Appreciation is one of the best benefits of homeownership. So many things we buy lose value as we use them—cars, clothes, computers—but not our homes. A well-maintained home gets more valuable every year. Appreciation is why we sign on to long-term mortgages and all those interest payments. We know in the end we will come out ahead.

While home appreciation varies greatly by location, the property data analysis firm Black Knight recently pegged the national average at 3.7% per year. But there has been nothing average about the past 20 or so months.

"Homes have seen double-digit growth for 40 consecutive weeks now," wrote Chris Morris at Fortune, summarizing May 2021 data from Realtor.com. "For the week ending May 15, the median listing price was up 15.5% year-over-year."

Get Free QuotesHow do your finances change when your home rapidly grows in value? We explore three nice side effects here.

Equity Explained

Equity is the value of your home minus the balance you owe on the mortgage. Month after month, while the balance grows smaller, your home's value likely increases. Over time, your equity grows not only because you owe less but also because you own more.

The less you owe, the more you own. That's the home equity seesaw.

To estimate how much your home is worth today, you can use this property value calculator at the Federal Finance Housing Agency. You enter your state, the purchase price, and the start/end dates to see how much the value of your home has changed since you bought it.

Estimates by Zillow can also give you a ballpark idea of your home's worth, although you should take those "Zestimates" with a grain of salt, cautioned realtor Bill Gassett. "Zillow and their Zestimate of value is not accurate," he stated bluntly in an advice forum. "In fact, if you look at the fine print on their site they will tell you so themselves. Their accuracy is appalling." He pointed out that the online service just doesn't know enough about your home to evaluate it. "Does anyone from Zillow visit your home to check on accuracy or information? No, they do not! Does Zillow know you just dumped $75,000 in improvements into your home? No!"

An Equity Example

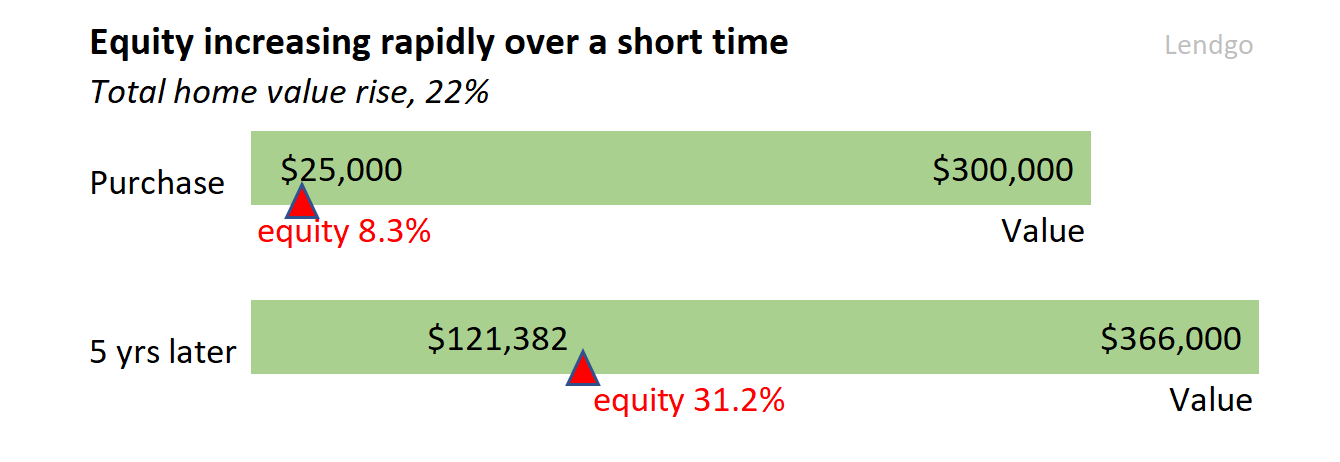

Let's say you bought a $300,000 home. You made a typical down payment of 8.3%, or $25,000. That down payment constitutes your equity on the first day of the mortgage.

Five years later, thanks to average appreciation and the remarkable spike in values over the past several months, your home is worth $366,000. The mortgage balance is down from an initial $275,000 to a current $244,618. While it is true that your payments have whittled down that balance over five years (a larger portion of early payments goes toward interest), what has caused your equity to really jump is the home's greater value.

Nice Side Effects of Increased Home Equity

Side effect number one of increased equity is that you can stop paying private mortgage insurance (PMI). Sometimes called lender's insurance, PMI is usually required when you make a down payment less than 20%. It is insurance you pay to cover the lender, not yourself. In the event that you default on your mortgage, the lender can collect insurance to cover some or all of its loss.

The key number when it comes to PMI is 20%. If you own 20% of your home from day one, lenders have confidence that you will not default, and you will not have to take out a PMI policy. But many homebuyers can't swing a down payment as large as 20%. They will only reach that equity share in time.

As soon as you attain 20% equity in your home, you can ask a lender to cancel your PMI, although you will have to pay for the reappraisal. Now that you own 20% of the home, you deserve the same high esteem from the lender as someone who paid 20% down. They have no reason to make you keep paying PMI.

Once you attain 22% equity in your home, by law the lender must cancel your PMI.

Thanks to rapidly increasing home values, you might have started the year making your usual PMI payment of $100 or more but can end the year that much richer. In just a few short months you might have sprinted across the critical 20% line due to rapid appreciation.

Related

What is PMI and can I avoid it?

Side effect number two of increased equity is that when you seize this opportunity of low rates to refinance your mortgage, you qualify for the best rates. Lenders determine someone's interest rate based on a number of factors, such as credit score, debt-to-income ratio (DTI), and payment history. Your larger equity makes you a better borrower now than you were when you got the original mortgage, and you will be rewarded with a lower rate. Let Lendgo match you to your best refi opportunities today.

The third nice side effect of greater home equity is that you can use some of your newfound equity for home improvements, thus helping you maintain or increase your home's value. The amount of cash you can collect when you replace your old mortgage for a cash-out refinance at today's historically low rates depends directly on your home's value. Due to rapidly increasing home values, you can collect more cash than before—enough to replace the whole roof, for example, or to install energy-saving windows. Home improvements that enhance equity are one of the smartest uses for a cash-out refi.

Conclusion

Home appreciation is a good bet anytime, but over the past year or two it has paid off like a slot machine. No matter how much of your home you owned 18 months ago, you probably own (a lot) more today. You could now parlay this windfall into a smart cash-out refinance to fund home improvements, or use it to secure a lower rate on a regular refinance. At the very least, your increased equity means you can now kiss PMI goodbye, for a savings of a hundred or so dollars every month.

Get Quotes Now