A good credit score can help you secure a lower interest rate when you open a credit account or borrow money, and it will help you qualify for better overall terms on home loans and car loans, and more. A poor credit score, however, will likely disqualify you from a loan altogether.

Although people talk about their credit score, you actually have several—more than a dozen, including main scores and subdivisions. FICO recently developed Score 10, but many companies are sticking with the earlier Score 8 because it suits their needs.

So what makes FICO Score 8 so special?

The eighth scoring scheme in the FICO system marked a big departure for Montana-based software analytics company, so much so that the employees now broadly divide all their scores into those before Score 8 and those after. Different scoring systems have different purposes.

For example, if you're applying for a credit card, they advise looking at your Score 8, but if you're purchasing or refinancing a home, "You'll likely want to know the base FICO Score versions previous to FICO Score 8."

Here's why your FICO Score 5 is the most important credit score in home loans.

Get Free QuotesAnytime you apply for a loan or credit, lenders will look at your credit reports and scores. This history helps them predict how likely you are to repay the debt in the future, whether you're seeking a mortgage, a car loan, a personal loan, or a credit card.

What's Special About FICO Score 8

Before FICO Score 8, data from each of the three credit bureaus contributed to a separate score.

- Score 2: Derived from information at Experian.

- Score 4: Derived from information at TransUnion.

- Score 5: Derived from information at Equifax.

Score 8 combines this data. Introduced by the Fair Isaac Corporation (FICO) in 2009, the blended score is intended to help both lenders and borrowers alike. For lenders, Score 8 is one number to reference instead of three. For borrowers, Score 8's algorithm weighs various debts differently and tries to paint a fairer picture of you.

For example, FICO Score 8 focuses on high-use credit cards more than earlier scoring schemes do. Do you carry a high balance, so high that you're almost at the limit? This will lower your Score 8 more than it lowered previous scores.

On the other hand, your Score 8 won't drop if you make a single late payment. What matters more now is whether you show a habit of paying late. Another advantage to borrowers is that Score 8 doesn't consider debt collection accounts that had an original balance under $100.

No matter the scoring scheme, the purpose of every FICO score is to assess a person's fitness to borrow money. "The various FICO Score versions all have a similar underlying foundation, and all versions effectively identify higher risk people from lower risk people," explains the company.

What's a Good FICO Score?

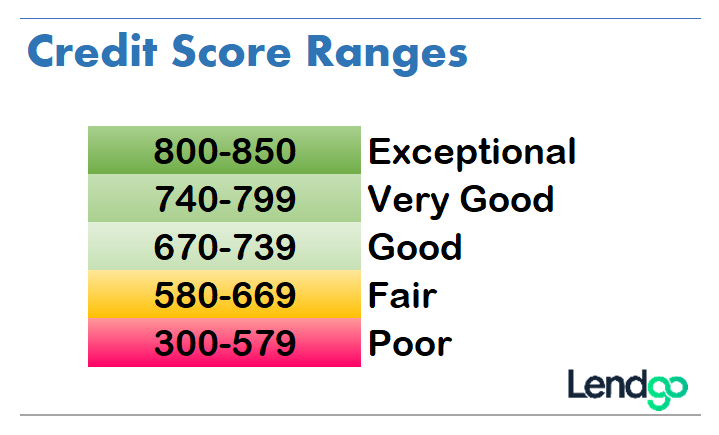

All scores fall on a scale of 300 to 850, with 670 marking the border between fair and good. Scores over 740 are very good. Scores under 580 are poor. These are specifically Experian's borders, but they mirror those of most lenders.

Who uses FICO Score 8?

Score 8 is most commonly used by credit card companies. They can pull your score from any of the three credit reporting agencies, also called bureaus. American Express writes, "FICO Score 8 is currently the most popular of many FICO scoring model versions that businesses use to size up a borrower’s risk."

The Parts of Your FICO Score

FICO's exact methodology is a trade secret, but the company has revealed the five main components of its scoring models.

- 35%—Payment history. The number-one concern every potential lender has is that you won't make your payments on time, so the biggest factor in your credit score is payment history. Missing a payment once won't hurt your Score 8 the way it hurts previous scores, but do your best to ensure it only happens once.

- 30%—Money owed. This is total you owe on loans and credit cards. Your credit score improves when you keep low balances relative to the limits; in other words, you use much less credit than is available to you, known as your debt utilization ratio, which we covered in the first section of a previous story.

- 15%—Length of credit history. Keep credit card accounts open even if you don't use them because creditors like to look far back.

- 10%—New credit. A new account has no history, so it doesn't help your score. Plus, qualifying for a new credit card usually involves a hard credit check, which can drop your score up to five points for as long as a year.

- 10%—Credit mix. Lenders like to see that you can juggle a variety of debts—credit cards, a car loan, and so on.

Inside this framework, the FICO algorithms weigh certain events in your credit history differently to come up with specialized consumer scores. The goal of combining three consumer credit scores into Score 8 was to better predict the likelihood of someone not repaying a loan as agreed, whether it's a mortgage, a credit card, a student loan, or another credit product.

The Best Ways to Raise Your Credit Score

As you can see from the list above, the two best ways to raise your FICO score are (1) to pay on time and (2) to charge less than you could charge. Combined, these habits make up two-thirds (65%) of your credit score.

Maintaining an emergency fund will help you avoid late payments because you won't be short on cash when an unexpectedly high bill arrives, such as after automobile repairs or a visit to Urgent Care. Consider setting up a recurring transfer from your checking account to a savings account on paydays. Such an automatic transfer would be barely noticeable and will seem like just another tax except you're paying yourself, not Uncle Sam. These transfers would automate the building up of an emergency fund.

Also, you could start saving money fairly easily in surprising ways, such as with these five household expenses you can cut.

Frugal habits and sticking to a budget will both help you lean on your credit cards less, thus improving your debt utilization ratio.

Naturally, you'll want to ensure that no mistakes appear on your credit report. Why should your score suffer because someone else screwed up? Order your free credit reports on the government-backed site annualcreditreport.com, the only site authorized by the Federal Trade Commission to give you free credit reports. Bookmark that link and tell your friends because if you search the web for "free credit reports," you'll get dozens of credit monitoring subscriptions disguised as free reports.

How much should you worry about your credit score?

When it comes to qualifying for the best mortgage terms, 740 is a good enough score, says Bay Area mortgage originator Joe Parsons. Once you've achieved that level, relax. "The only real benefit of having a credit score over about 760 is bragging rights. From a mortgage standpoint, 740 gives you the best interest rate, 760 gives you the best rate for mortgage insurance, if applicable. Higher than that, there is no additional benefit."

How about the age-old trick of getting onto someone else's account to improve your own score? That doesn't work for FICO 8.

FICO Score 8 Puts an End to the "Authorized User Hack"

One strategy that credit repair businesses have long used to raise someone's credit score is by making the person an authorized user on the account of someone with good or exceptional credit. Thus, the aura of creditworthiness would envelope both people. Score 8 eliminates any advantage that used to come from piggybacking on someone else's good credit by spotting unintended usage, like authorized users who aren't related to the cardholder.

FICO Score 8 Takeaways

- FICO Score 8 combines information from all three credit reporting agencies.

- Score 8 forgives a single late payment but judges more harshly a habit of late payments.

- Score 8 ignores collections accounts under $100 while focusing on credit cards with balances near the limit.

- The two best ways to raise all your credit scores are to pay on time and use credit sparingly.