In school you had a report card. In adulthood you have a credit score.

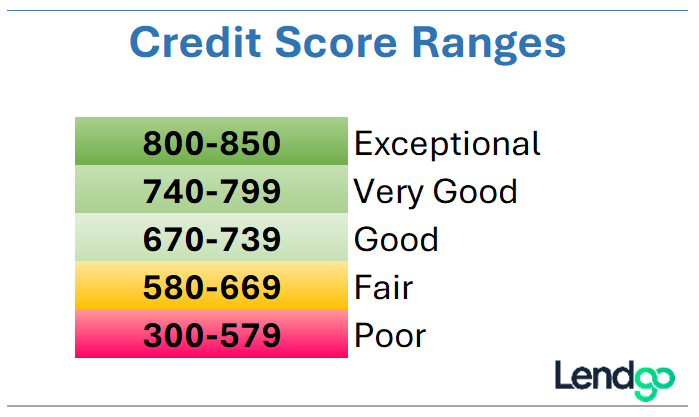

A good credit score (740 or higher) will entitle you to a low interest rate on a mortgage, a personal loan, and credit cards. Those unbelievably low rates you see on TV for new cars? They are almost always reserved for people with the high credit scores. From lenders to landlords to some hiring managers, more people could be checking your credit score than you realize.

The Fair Isaac Corporation (FICO) developed multiple scoring models to cover separate situations. For example, your FICO Score 5 matters most to mortgage lenders. Regardless of the FICO scoring model, all the scores serve the same fundamental purpose: to identify lower risk people from higher risk people.

One of the newest credit scoring models is FICO Score 9.

Building on the success of FICO Score 8, which remains widely popular among credit card companies, FICO's development team introduced Score 9 to all three credit bureaus in late 2014. The goal was to maximize the benefit of blending your history from Equifax, Experian, and TransUnion, a major innovation that Score 8 was the first FICO score to do.

Prior to FICO Score 8, your credit history at each of the three credit reporting agencies fed into its own FICO score.

- Score 2: Pulled information from Experian.

- Score 4: Pulled information from TransUnion.

- Score 5: Pulled information from Equifax.

After FICO Score 8, FICO's data cooks knew they had their work cut out for them to develop another recipe that would blend the ingredients from all the credit reporting agencies and bake it into a better pie. "Because of the strength and robustness of our earlier scores, the challenge to leapfrog our existing scores is considerable," admitted FICO's Frederic Huynh. He added, "I believe we have cleared that very high bar" with FICO Score 9.

So what's different about FICO Score 9? We explain the major changes.

FICO Score 9 Treats Medical Debts More Fairly

What does your medical history have to do with your ability to manage credit? Nothing. FICO Score 9 recognizes this fact. After all, excellent money managers on the one hand, and spendthrifts who max out all their credit cards on the other hand, are equally likely to suffer a costly injury or be diagnosed with an expensive condition.

Now with FICO Score 9, any medical bills you have in collections won't harm your score as much as they do under previous scoring models. Such accounts still matter, just not as much, which is fairer to you.

Last year the Consumer Financial Protection Bureau reported that 58% of bills that are in collections and on people’s credit records are medical bills. Since many people become responsible for medical debt due to billing conflicts between healthcare providers and insurance companies and only learn of this debt when the account goes to collections, it's great that FICO Score 9 treats them more fairly.

FICO Score 9 Ignores Closed Collections Accounts

Did you have an account go to collections and you handled it? Presto! It disappears as far as FICO Score 9 is concerned. While the history remains in your file for seven years per the Fair Credit Debt Collections Reporting Act, it's invisible to Score 9.

This is terrific for many consumers in an age when sending an account to collections is as much a strong-arm negotiating tactic as a reflection of a person's financial habits. While you are actively and legitimately disputing a charge, for example, the company might send it to collections to shut you up.

Related

5 tips to destress your finances

FICO Score 9 Includes Rent Payments If Reported

Paying one's rent on time shows a financial discipline second only to paying one's mortgage on time, but until Score 9, your reputation as a great renter wouldn't help your credit score. Now if your rental history is reported, FICO will roll it into your Score 9.

In a pilot program run by the nonprofit Credit Builders Alliance and the Citi Foundation, 80% of renters who participated in rent reporting boosted their credit score by an average of 23 points.

Only 27% of landlords report rental payments to a credit bureau, according to a recent story by TransUnion, but the rate is expected to climb as reporting becomes easier for property managers. If your landlord doesn't participate yet, you can still get credit for your good rental history by having it reported another way.

Report your own rental history for free.

If your landlord doesn't report rent to one of the credit bureaus, we know of at least two free ways you can take the reigns and get it reported yourself. The most popular way is Experian Boost, which looks at rental history, phone accounts, streaming subscriptions, and more to potentially raise your credit score. Another free reporting tool is Pinata, which bills itself as "the reward and credit building app for renters."

Aside from free ways like the two we just mentioned, many services will report your rental history for an ongoing monthly fee ($3-$10) and sometimes an initial setup charge too. Obviously, free is better. Anyone with at least one credit card account can use Experian Boost.

Remember, your rental history will affect your FICO Score 9 if reported, but it won't affect the score currently used most often for mortgages. Read why FICO Score 5 is what matters to mortgage and refi lenders.

Who Uses FICO Score 9?

Currently most companies that relied on Score 8 are sticking with it, a situation that surely vexes the scientist at FICO who worked so hard to build a better model. Migration to Score 9 has been slower than expected due to costs that FICO, for its part, did try to minimize.

Credit card companies have proven especially stubborn. American Express said, "FICO Score 8 is currently the most popular of many FICO scoring model versions that businesses use to size up a borrower’s risk." Citi currently providers its cardholders free access to their Score 8. Chances are if you view your score via a credit card company today, you see either FICO Score 8 or a VantageScore.

The Building Blocks of Your FICO Score 9

FICO will not reveal the science behind the Score 9 model except to say that all FICO scores are made up of five categories. Here are the building blocks that create your score.

Your payment history has the greatest effect on your FICO score, to the tune of 35%. Anyone considering loaning money to you wants to know that you'll repay it as scheduled, so they look at your track record. Score 9 (like Score 8) forgives one late payment in an otherwise spotless record.

The next big category is the money you owe on all loans and credit cards. Running cards up near their limits lowers your score. Lenders like to see restraint. Your score improves when you have access to significantly more credit than you use.

Size matters when it comes to your credit history file. People with brief credit histories ("thin files," they're called) are assumed to be higher risk, a bias that Score 9 addresses head-on. Keep reading to learn how you can fatten this proverbial file yourself and improve your FICO Score 9.

The last two components of your FICO score, weighing 10% each, are your new credit accounts and your credit mix. New accounts generally harm your score for two reasons. First, the company probably did a hard credit check when you applied, which can subtract five points from your score for as long as a year. Second, new accounts have no history. Can you handle the additional payment? Nobody can tell yet. A diverse credit mix—credit cards, a car loan, a mortgage, and so on—shows lenders you can qualify for and juggle various debts.

The well-rounded assessment behind Score 9 has resulted in millions of consumers scoring higher than they would have under previous schemes, FICO says.

FICO Score 9 Hopes to Become a Universal Credit Score

Since the launch of Score 8—the first FICO score to combine information from Equifax, Experian, and TransUnion—the company has enjoyed tremendously positive feedback for creating one score to reference in place of three. In fact, credit card issuers are so happy with Score 8 that a move to Score 9 is happening slower than FICO probably wants.

"More organizations are relying on a single score throughout their enterprise so that all lines of business can operate with a lingua franca of risk," wrote Frederic Huynh. Lenders want one score to reference, not several. They got this with FICO Score 8, and to win them over to a new scoring model, FICO had to build upon the idea of one score for everything.

For FICO Score 9, the statisticians developed a scoring model they hope will be more predictive than any before it. They call it multifaceted modeling, and it's company-confidential but no doubt complex and advanced.

"FICO Score 9 represents our best analytic work to date," said FICO's Jim Wehmann. "It delivers even more value to lenders, while minimizing the effort needed to upgrade."

Credit Repair Services Hate FICO Score 9

Companies that make money by trying to raise people's credit scores were none too happy with the launch of FICO Score 9. Like its predecessor, Score 9 continued the practice of neutering "unauthorized use" of the authorized user feature, as credit card companies saw it.

An example of authorized use, per American Express, is when parents add a child to their credit card as an authorized user to help the child build credit history. This practice is still OK with FICO Score 9. Adding family to a card is how the feature is meant to work.

FICO Score 9 is better than older scores at spotting attempts to use the "authorized user hack" to game the system. Not related to the cardholder? Not even living in the same state? And the cardholder is younger than you? (FICO won't reveal what it's screening for, but these are our best guesses.) If so, then piggybacking on that account won't help your Score 9.

FICO Score 9 Is More Accurate for People With Little Credit History

Since the best predictor of how people will manage their money in the future is how they did so in the past, lenders and creditors like to see long credit histories. Fair or not, you are judged a higher risk if your credit history is scant. In the industry, these cases are called "thin files."

FICO Score 9 compensates for short credit histories by examining other activity that speaks to your ability to manage money, such as rent payments.

And it works! The well-rounded assessment behind Score 9 has resulted in millions of consumers scoring higher than they would have under previous schemes, FICO says. The higher scores allow more people to meet the minimum requirements of most lenders, so those people can open accounts and start building a credit history.

Where to Get Your Free FICO Score

Check with your credit card company because many give their cardholders free access to their credit score. The score could come from one of two places, FICO or VantageScore. While knowing either score is helpful, lenders favor FICO scores.

According to CNBC, these credit card companies show members their FICO score for free:

- American Express

- Bank of America

- Citi

- Discover

- Wells Fargo

Capital One gives free VantageScores to cardholders.

FICO Score 9 Key Takeaways

- FICO Score 9 combines information from all three credit reporting agencies.

- Score 9 views medical collections more gently and ignores paid collections entirely.

- Millions of people with limited credit history score higher under the new model.

- While the two best ways to raise your credit scores remain paying on time and using credit sparingly, Score 9 is the first FICO score that rewards you for being a good renter.